Call Now : 347-997-4711

Turning 65 Medicare in Forest Hills, NY

Trusted Medicare Enrollment Guidance & Personalized Coverage Support

Reaching 65 is a big milestone, and if you live in Forest Hills, New York, it also marks the time to make important decisions about your healthcare coverage. Medicare isn’t a one-size-fits-all program; it includes several parts, options, and enrollment windows that affect not only your benefits but also your medical cost responsibilities.

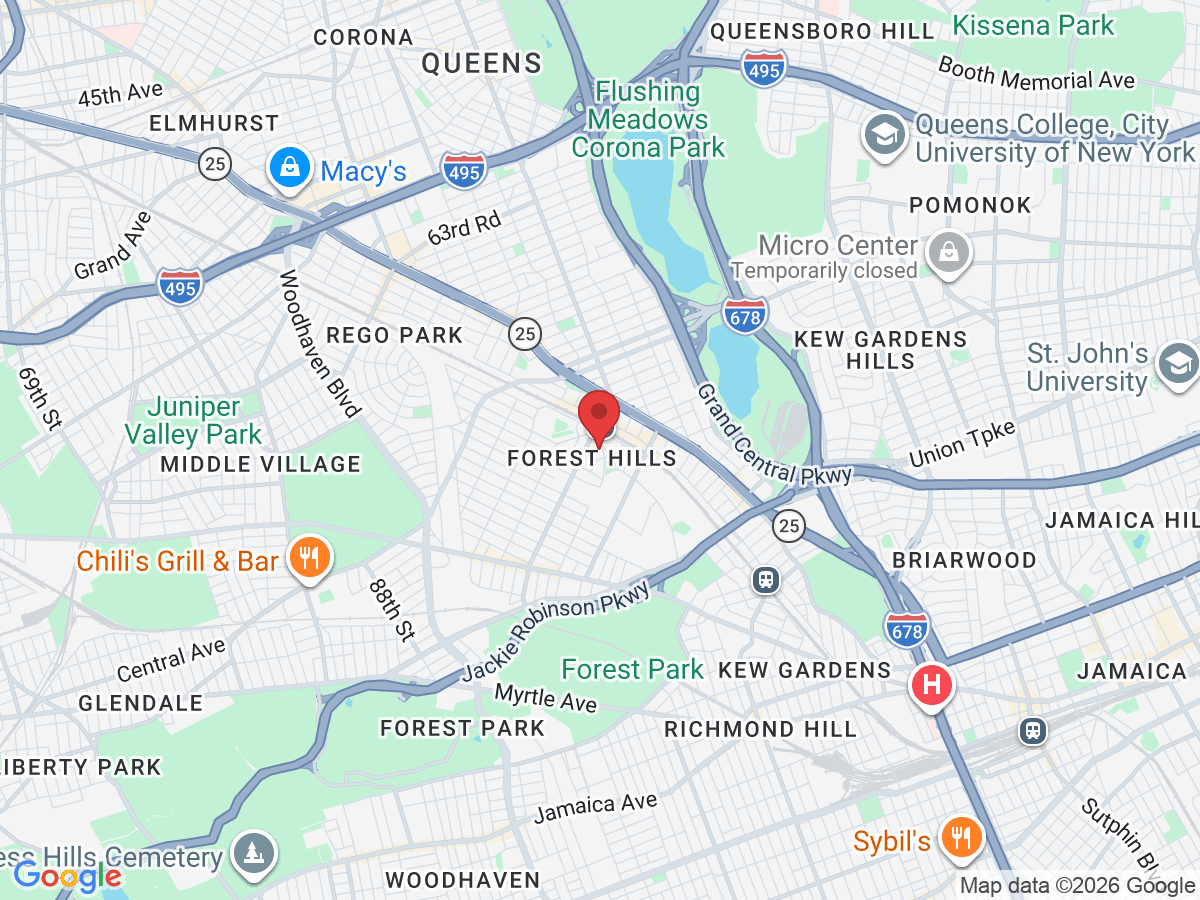

Whether you’re near Austin Street, Forest Hills Gardens, Briarwood, Kew Gardens, or any nearby Queens community, the key is understanding how Medicare works before you commit.

At HCA Insurance & Senior Solutions, we help Forest Hills residents turning 65 navigate Medicare in Forest Hills, NY, in clear, understandable terms. We focus on educating you about your coverage options and aligning them with your health needs and financial goals. Instead of high-pressure sales, you’ll get honest, customized advice from experienced licensed Medicare advisors near you.

📞 Schedule a no-cost consultation today with a Medicare specialist who can walk you through the enrollment process and answer your questions without confusion.

Our Medicare & Retirement Services in Forest Hills

What Happens When You Turn 65 in Forest Hills, NY

Understanding Medicare Eligibility

When you turn 65 in Forest Hills, NY, Medicare eligibility begins, but knowing the timeline and your options is essential:

Initial Enrollment Period: A seven-month timeframe that starts three months before your 65th birthday and continues three months after

Medicare Part A: Covers inpatient hospital care and certain home health services

Medicare Part B: Covers outpatient care, doctor visits, preventive services, and medical supplies

Medicare Part D: Optional prescription drug coverage through private plans

Medicare Advantage (Part C): Medicare plans offered by private insurers that may include additional benefits

Medicare coverage can be straightforward once you understand the parts and how they interact. Our medicare advisors near you make this easy to follow and tailored to your situation.

Key Enrollment Timelines & Deadlines

Timing isn’t just a suggestion; it can impact costs and coverage.

Start early: Begin reviewing your Medicare options 3–6 months before your eligibility window opens

Sign up on time: Enroll during your Initial Enrollment Period to avoid late penalties

Employer coverage: If you have insurance through work, timing affects when Medicare should start

Special Enrollment Periods: Available in certain life situations like retirement, job change, or loss of existing coverage

Making decisions within the right timeframes ensures you get coverage when you need it, without unnecessary expenses.

Prescription Drug Coverage & Cost Considerations

Prescriptions are an important piece of Medicare planning, especially if you take regular medications:

Review Part D plan formularies tailored to your personal medications

Understand pharmacy network differences and cost tiers

Estimate yearly medication expenses based on plan choices

Adjust plans during open enrollment to stay aligned with changing needs

Reviewing drug coverage helps you avoid surprise costs and ensures you’re in a plan that truly matches your health profile.

About Medicare Guidance in Forest Hills, NY

When to Contact a Medicare Advisor

Medicare planning is smarter when done early and with expert help:

Six months before your 65th birthday: Start exploring coverage options

Before your enrollment window ends: Ensure timely coverage activation

When retiring or leaving employer coverage: Coordinate Medicare with other insurance

During annual review periods: Reevaluate your plan to match changing needs

The earlier you talk to a professional, the more confident your decisions become.

What Our Medicare Advisors Do

Walk you through plan options in plain language

Help you fill out and submit enrollment forms on time

Compare Medicare Advantage and Part D plans available in Forest Hills

Provide annual coverage reviews to adapt as your health evolves

We aim to be your lifelong Medicare resource, providing support long after enrollment.

Local Healthcare & Senior Resources in Forest Hills

Medicare planning often connects with community support systems that help seniors throughout daily life:

Local hospitals and medical centers for preventive care and treatment

Pharmacies that participate in drug plans

Senior education and health literacy programs

Community advocacy organizations for older adults

Financial advisors helping link Medicare with retirement income

These additional resources complement Medicare guidance and strengthen your overall healthcare planning.

What Forest Hills Clients Say

“HCA Insurance made Medicare enrollment feel manageable. They broke everything down and answered even my smallest questions.” — Diane H., Forest Hills

“They looked at my prescription needs and doctors before suggesting plans. I didn’t feel rushed or pushed.” — James M., Forest Hills

Schedule Your FREE Forest Hills Medicare Enrollment Consultation

Three Easy Ways to Meet:

🏢 Office Visit – Meet with a licensed Medicare advisor in the community

🏠 Home Visit – Personalized coverage review from your living room

📞 Phone Consultation – Comprehensive support over the phone

Get Your FREE Turning 65 Medicare Plan Review

No pressure, no obligation, just honest, clear, and personalized Medicare guidance designed around your doctors, prescriptions, and long-term goals.

Serving Forest Hills & Surrounding Areas

Also providing Medicare planning services in:

Kew Gardens • Rego Park • Glendale • Briarwood • Elmhurst • Jackson Heights • Middle Village • Corona • Richmond Hill • Queens

Local Forest Hills Medicare Agent: HCA Insurance & Senior Solutions

Service Area: Forest Hills, NY

Phone: 518-888-6622

Email: [email protected]