Call Now : 347-997-4711

Turning 65 Medicare in East Flatbush, Brooklyn, NY

Trusted Enrollment Guidance & Personalized Medicare Coverage Support

Turning 65 is a major milestone, especially when it comes to health coverage. For many residents of East Flatbush and surrounding Brooklyn neighborhoods, it’s the moment when Medicare becomes more than an idea, it becomes a real choice with real financial implications. Planning for Medicare means understanding parts, enrollment windows, deadlines, and options that can affect your access to care and your wallet.

At HCA Insurance & Senior Solutions, we provide clear, unbiased guidance to individuals turning 65 Medicare in East Flatbush, Brooklyn. Our licensed Medicare advisors specialize in breaking down complex coverage information into easy-to-understand language. We’ll help you explore the variety of coverage choices available based on your medical needs, lifestyle, and budget, so you can make confident decisions without stress.

📞 Schedule a no-cost consultation today to speak with a trusted Medicare advisor serving East Flatbush and beyond.

Our Medicare & Retirement Services in Brooklyn

Understanding Medicare When You Turn 65 in East Flatbush, NY

What Medicare Eligibility Means

Medicare is a federal healthcare program that becomes available once you turn 65, but eligibility alone doesn’t automatically enroll you in every part of it. Knowing the basics helps separate confusion from clarity:

Initial Enrollment Period (IEP): A seven-month window around your 65th birthday during which you can sign up

Part A: Hospital insurance covering inpatient stays and certain skilled services

Part B: Outpatient and medical services such as doctor visits and preventive care

Part D: Prescription drug coverage through private insurers

Medicare Advantage (Part C): All-in-one private plans that may offer extra benefits

Understanding how these pieces fit together helps you choose the right path for your personal situation.

Importance of Enrollment Timing

When you enroll matters just as much as what you enroll in. Signing up outside your eligibility window can lead to coverage delays and late enrollment penalties.

Begin your enrollment process at least three months before your 65th birthday

If you have employer coverage, coordinate timing to prevent gaps

Be aware of special enrollment periods triggered by retirement, job changes, or loss of group health coverage

Our advisors help you identify which enrollment window applies so you can avoid costly mistakes.

Medicare Coverage Choices for East Flatbush Residents

Comparing Plan Options

Once eligible, you’ll need to compare Medicare plans in East Flatbush to decide what meets your needs:

Original Medicare (Parts A & B): Coverage through the federal program with broad provider access

Medicare Advantage Plans (Part C): Bundled policies that often include dental, vision, hearing, and drug coverage

Medigap (Supplemental Insurance): Helps cover deductibles and coinsurance not paid by Original Medicare

Prescription Drug Plans (Part D): Standalone plans are helpful for medication coverage

Each plan type has pros and cons depending on your health needs and financial situation. We help simplify these differences so you can make educated decisions.

Prescription Drug Coverage & Cost Planning

Medication expenses can be unpredictable, especially as you age. That’s why choosing the right prescription drug coverage is crucial:

Evaluate Part D plans based on your current medications

Compare how different plans cover brand-name and generic drugs

Estimate expected yearly drug costs under different policies

Adjust coverage over time as medications change

Making the right Part D choice can significantly reduce your out-of-pocket drug costs.

About Medicare Guidance in East Flatbush, NY

When to Contact a Medicare Agent

Consulting a licensed Medicare expert at the right time makes all the difference:

Start conversations about 3–6 months before turning 65

Before your IEP expires, to avoid penalties

During retirement planning or job transitions

When prescriptions or health needs change

Proactive guidance prevents gaps in coverage and unnecessary expense.

What Our Brooklyn Medicare Advisors Provide

Personalized guidance through enrollment forms

Comparison of available Medicare Advantage and Part D plans

Annual coverage review to ensure plan suitability

Help with claims, benefit questions, and plan changes

We aim for clarity, not confusion, helping you feel confident before and after enrollment.

What East Flatbush Clients Say

“When I first looked at Medicare, everything felt confusing. My advisor explained the parts clearly so I finally understood my options.” — Eleanor F., East Flatbush

“They didn’t just show me plans — they helped me pick one that fit my doctors and prescriptions. I felt supported the whole way.” — David R., East Flatbush

Schedule Your FREE East Flatbush Medicare Enrollment Consultation

Three Easy Ways to Meet:

🏢 Office Visit – Talk with a licensed advisor at a Brooklyn location

🏠 Home Visit – Detailed Medicare support in your home

📞 Phone Consultation – Helpful guidance from wherever you are

Get Your FREE Medicare Plan Review

No stress, just direct, specialised support designed around your health, prescriptions, and preferred doctors, so you understand what each plan offers and how it impacts you.

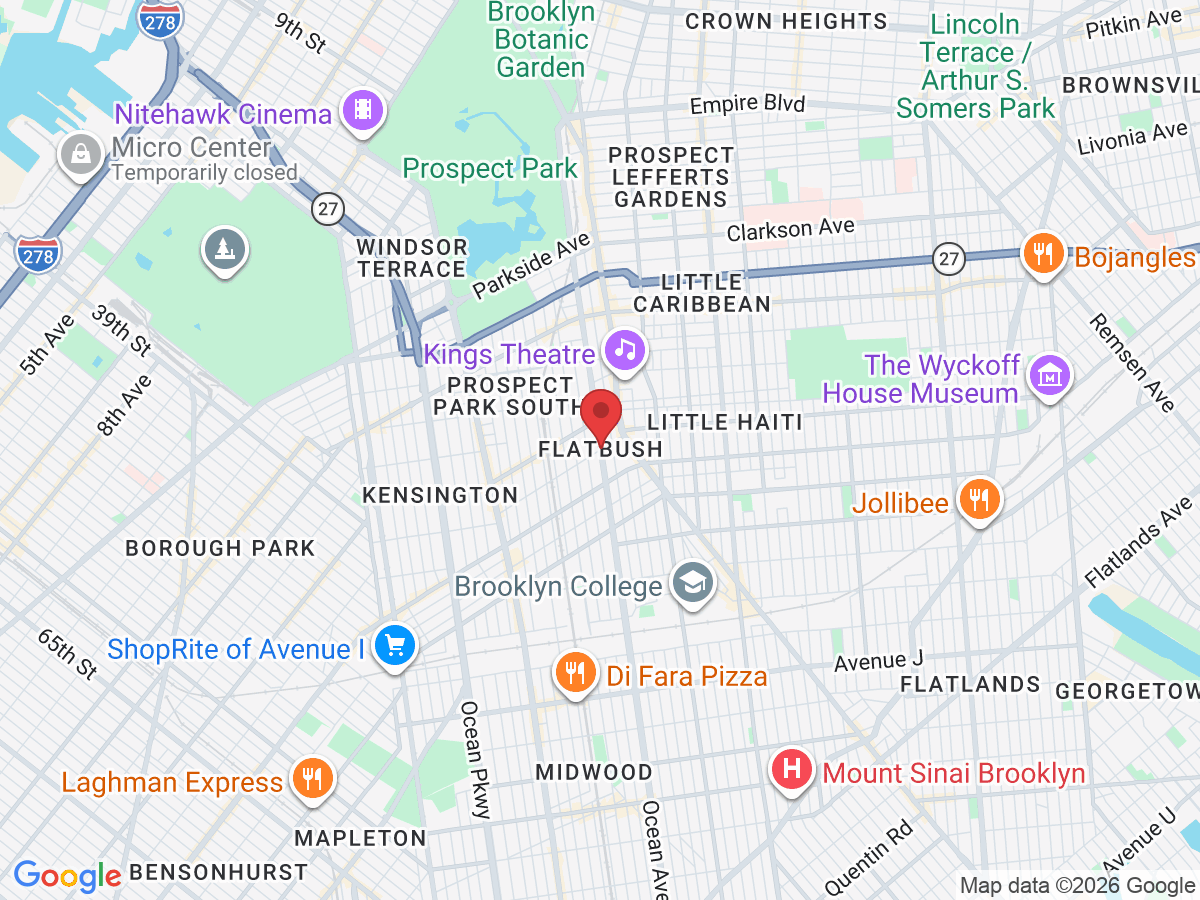

Serving East Flatbush & Surrounding Areas

Also providing Medicare planning services in:

East Flatbush • Flatbush • Midwood • Crown Heights • Prospect Lefferts Gardens • Bedford-Stuyvesant • Canarsie • Brownsville • Sheepshead Bay • Brooklyn Heights

Local Brooklyn Medicare Agent: HCA Insurance & Senior Solutions

Service Area: Brooklyn, NY

Phone: 518-888-6622

Email: [email protected]